In an era where corporate integrity is paramount, we understand the critical importance of safeguarding your business from fraudulent activities. Our dedicated team of experienced investigators specializes in resolving complex schemes and fraudulent practices that threaten your organization.

Our Corporate Fraud Investigations are conducted with the utmost discretion and adherence to legal and ethical standards. We deploy cutting-edge surveillance techniques, leveraging both physical and technological means to uncover the truth. From internal financial irregularities to external threats, SCORP’s experts are equipped to handle a spectrum of fraudulent activities.

At SCORP, we recognize that every case is unique, and our tailored approach ensures that our investigations are aligned with your specific concerns. Whether you suspect embezzlement, asset misappropriation, or other fraudulent activities, our team is committed to delivering actionable insights that empower you to protect your assets and preserve the integrity of your business.

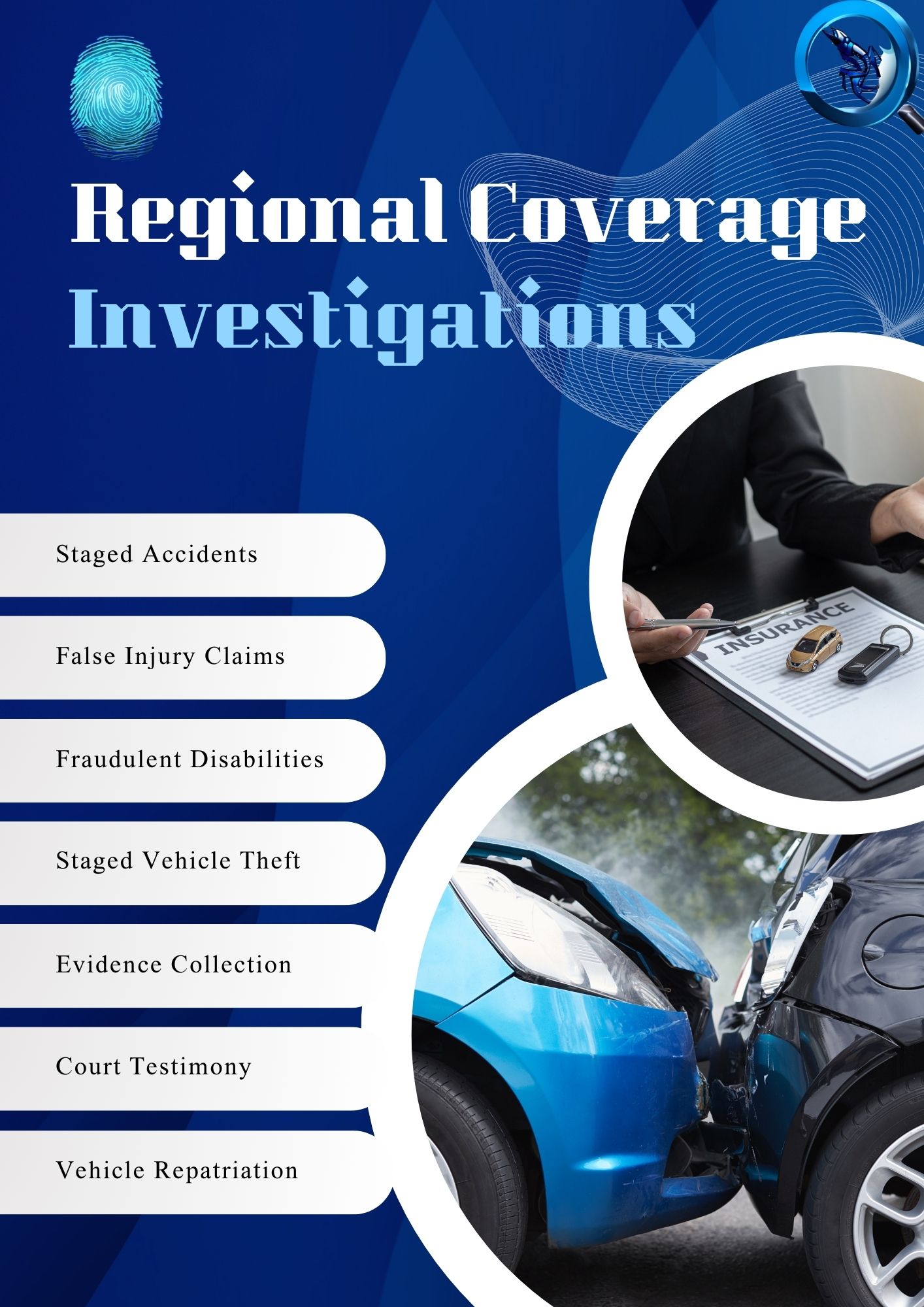

At SCORP, we specialize in providing compelling evidence and generating legally admissible reports for cases involving insurance fraud, deceptive disability compensation claims, and fraudulent welfare program recipients. Our meticulous approach to insurance claim investigations encompasses thorough evidence collection, comprehensive interviews, and meticulous record analysis. Our reports are strategically crafted to assist insurers in making informed decisions, differentiating between legitimate and illegitimate claims.

Our surveillance and covert investigations adhere to the highest professional and ethical standards, in alignment with the Law on detective activity of the Republic of Serbia. We employ various forms of surveillance, including stationary, mobile, and electronic methods. Our lead private investigator conducts a comprehensive analysis of the subject’s profile before initiating surveillance, enabling us to determine the most effective approach tailored to the unique specifics of each case and the individuals under investigation.

Trust SCORP for precise and ethical investigative services that clarify complex situations, empowering you to make well-informed decisions.

At SCORP, our commitment to delivering comprehensive Corporate Fraud Investigations & Surveillance services extends beyond our internal capabilities. We take pride in our strategic partnership with Absolut Support, a reputable agency licensed in risk assessment and consulting. Together, we create a powerful alliance, bringing a wealth of expertise to assess organizations comprehensively from all angles and recommend the most effective security solutions.

Comprehensive Organizational Assessment

The collaboration between SCORP and Absolut Support allows for a holistic evaluation of your organization’s security landscape. Our collective expertise encompasses corporate fraud investigations, surveillance, risk assessment, and consulting, ensuring no aspect is overlooked.

Multi-Angle Approach

By leveraging the diverse skill sets of both agencies, we adopt a multi-angle approach to assess potential vulnerabilities, weaknesses, and areas of concern within your organization. This strategic collaboration enables us to provide a nuanced perspective on corporate security, considering factors ranging from internal operations to external threats.

Tailored Security Solutions

SCORP and Absolut Support work in a team to tailor security solutions specifically designed to address your organization’s unique challenges. Whether internal fraud, external threats, or a combination of both, our collaborative approach ensures that security measures are customized to fit your needs.

Licensed Expertise

Absolut Support’s expertise in risk assessment and consulting and SCORP’s proficiency in corporate fraud investigations create a synergy of licensed professionals dedicated to enhancing your organization’s security posture. Both agencies operate within the legal framework, ensuring our assessments and recommendations adhere to regulatory standards.

Proactive Risk Mitigation

The collaboration extends beyond the mere identification of risks; it involves proactive risk mitigation by combining our resources; SCORP and Absolut Support work hand in hand to develop proactive strategies and implement robust security measures that fortify your organization against potential threats.

Trustworthy Recommendations

SCORP and Absolut Support pride themselves on providing trustworthy and actionable recommendations. Our collaboration aims to empower your organization with the insights needed to make informed decisions regarding security enhancements, fraud prevention, and surveillance measures.

Enhanced Effectiveness

The partnership between SCORP and Absolut Support enhances the overall effectiveness of our Corporate Fraud Investigations & Surveillance services. By pooling our resources and knowledge, we offer a comprehensive and integrated solution beyond traditional investigative and security measures.

Choose SCORP and Absolut Support for Corporate Fraud Investigations and benefit from a collaborative approach that combines the strengths of two agencies with a shared commitment to elevating your organization’s security. Our partnership brings together licensed experts in fraud investigations, surveillance, risk assessment, and consulting to provide you with unparalleled insights and security solutions.

Surveillance plays a pivotal role in insurance fraud investigations, acting as a critical tool to uncover deceptive activities and provide concrete evidence for claims adjudication. The importance of surveillance in these investigations cannot be overstated, considering the intricate nature of fraudulent claims and the potential financial ramifications for insurers.

One of the primary advantages of surveillance lies in its ability to validate the accuracy of the information provided by claimants. Through systematic and discreet observation, investigators can confirm the legitimacy of reported injuries, the extent of property damage, or the circumstances surrounding an incident. This helps prevent payouts for fraudulent claims and ensures that genuine claims are processed accurately.

Surveillance is particularly effective in cases of staged accidents, false injury claims, and other forms of orchestrated fraud. By employing advanced techniques such as video documentation, photographic evidence, and real-time monitoring, investigators can reveal patterns of deceit that may otherwise go undetected. This proactive approach not only protects insurers from financial losses but also acts as a deterrent, sending a strong message that fraudulent activities will be identified and addressed.

Furthermore, surveillance is instrumental in maintaining the integrity of the insurance industry. The ability to adapt and employ cutting-edge surveillance methods becomes essential in a landscape where fraud schemes continually evolve. It allows insurers to stay one step ahead, ensuring accurate risk assessment and the fair pricing of policies.

At SCORP, we recognize the vital role of surveillance in insurance fraud investigations. Our specialized team of investigators employs a combination of traditional and advanced surveillance techniques to unveil the truth behind claims. Through meticulous observation and data collection, we provide insurers with the clarity needed to make informed decisions, safeguard the industry’s financial stability, and preserve the trust of policyholders.