Welcome to SCORP, your dedicated partner in combating insurance fraud through our specialized investigations and comprehensive solutions. Our experienced team of investigators is committed to uncovering fraudulent activities in the insurance industry, offering concrete evidence to support your claims handling process.

Recognizing the unique challenges of insurance fraud investigations in the Western Balkans region, we have forged strong relationships with local authorities and stakeholders to ensure the effectiveness of our services.

We proudly announce our established presence and partnership with reputable investigation firms in the European Union. When you choose to work directly with us, you benefit from our expertise and enjoy lower fees by bypassing intermediaries without compromising the quality of our investigations.

Our range of services includes:

- Fraudulent Claims Investigations:

- In-depth examination of suspicious insurance claims, encompassing car accidents, vehicle theft, and property damage.

- Collection and analysis of relevant evidence, including accident reports, witness statements, surveillance footage, and medical records.

- Collaboration with law enforcement agencies, insurance industry databases, and forensic experts to fortify the investigation.

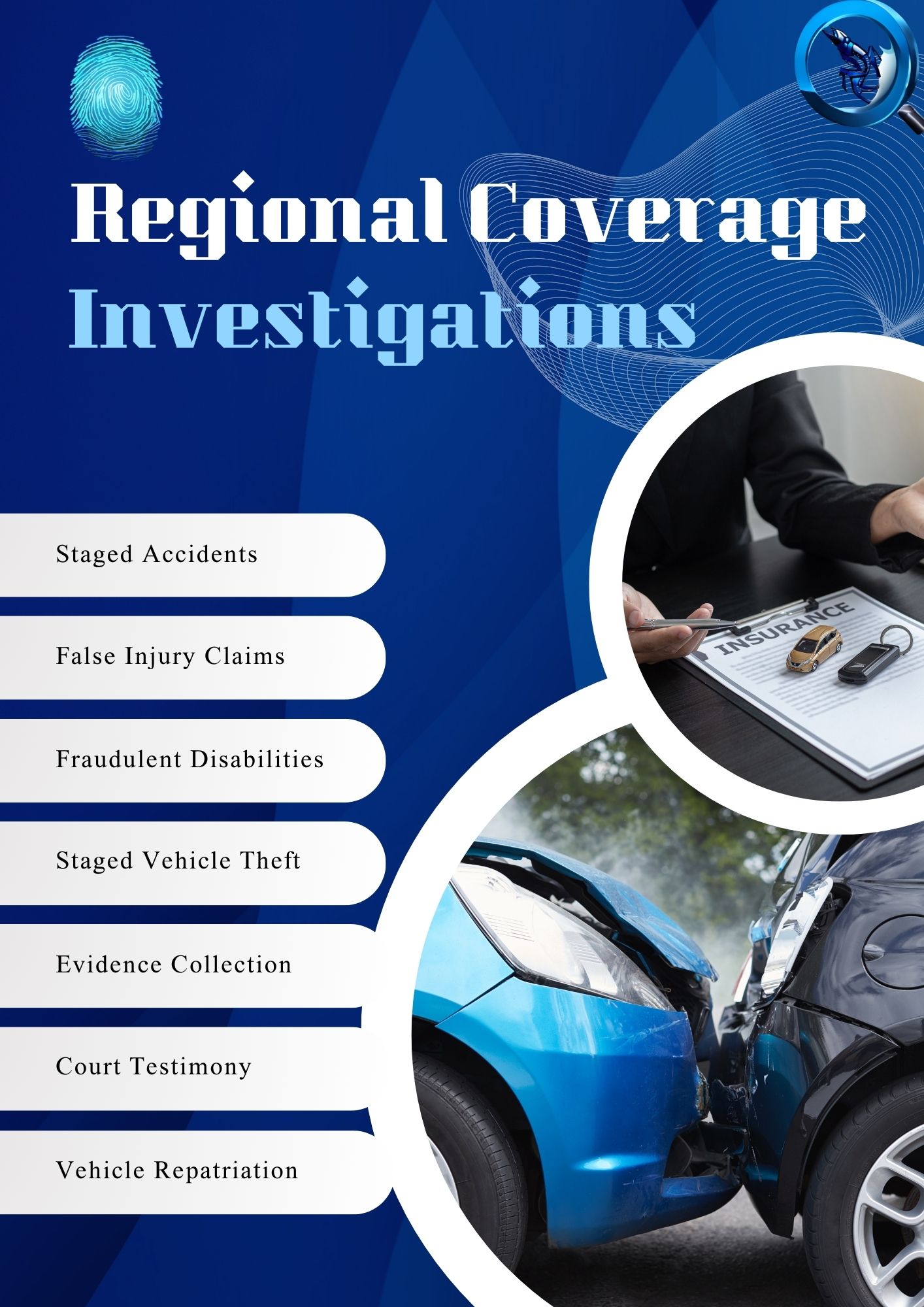

Insurance Fraud Investigations

We proactively identify and investigate fraudulent insurance-related activities, such as staged accidents, false injury claims, fraudulent disabilities, and vehicle theft.

Advanced investigative techniques, including covert surveillance, background checks, and data analysis, are utilized to detect fraud patterns.

Vehicle Repatriation Services

- Prompt and efficient retrieval of stolen or fraudulently claimed vehicles.

- Collaboration with local authorities, law enforcement agencies, and international partners to facilitate the repatriation process.

- Comprehensive documentation and support throughout the repatriation process, ensuring compliance with legal and regulatory requirements.

Legal Support and Expert Testimony

Providing expert opinions and testimony reinforces your legal proceedings in insurance fraud cases.

Collaboration with legal professionals and insurers to provide robust evidence and assist in achieving favorable outcomes.

At SCORP, we are dedicated to safeguarding the integrity of the insurance industry, providing tailored solutions to address the intricate challenges of fraudulent activities.

Trust us for reliable, efficient, and results-driven services in insurance fraud investigations and vehicle repatriation.